Australia: Financial Condition Outlook

- The EPF Atlas

- Jan 22

- 1 min read

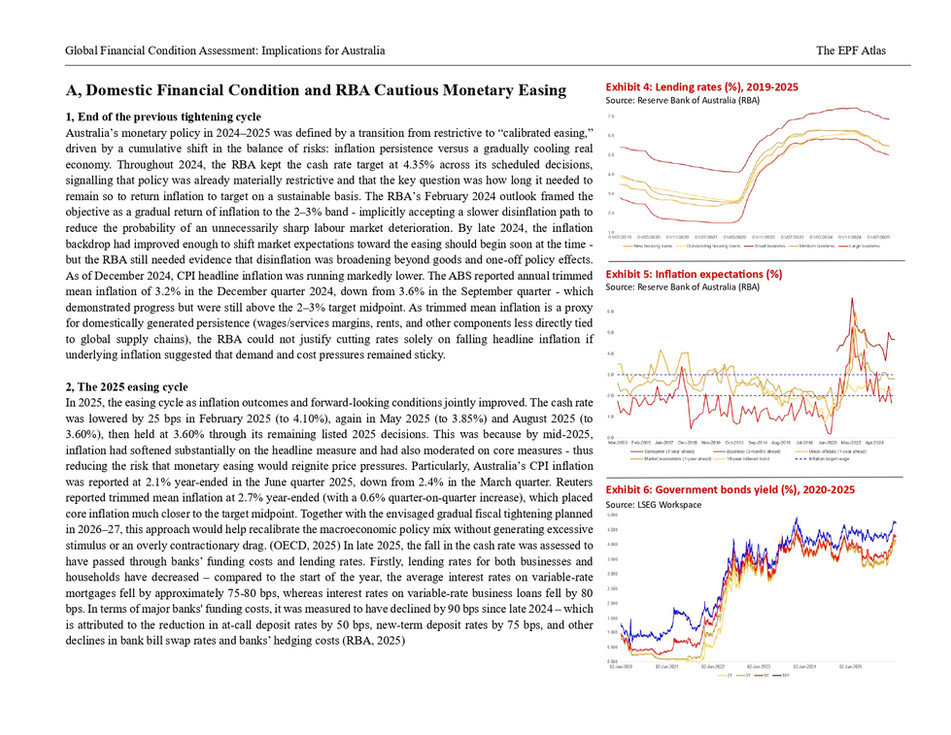

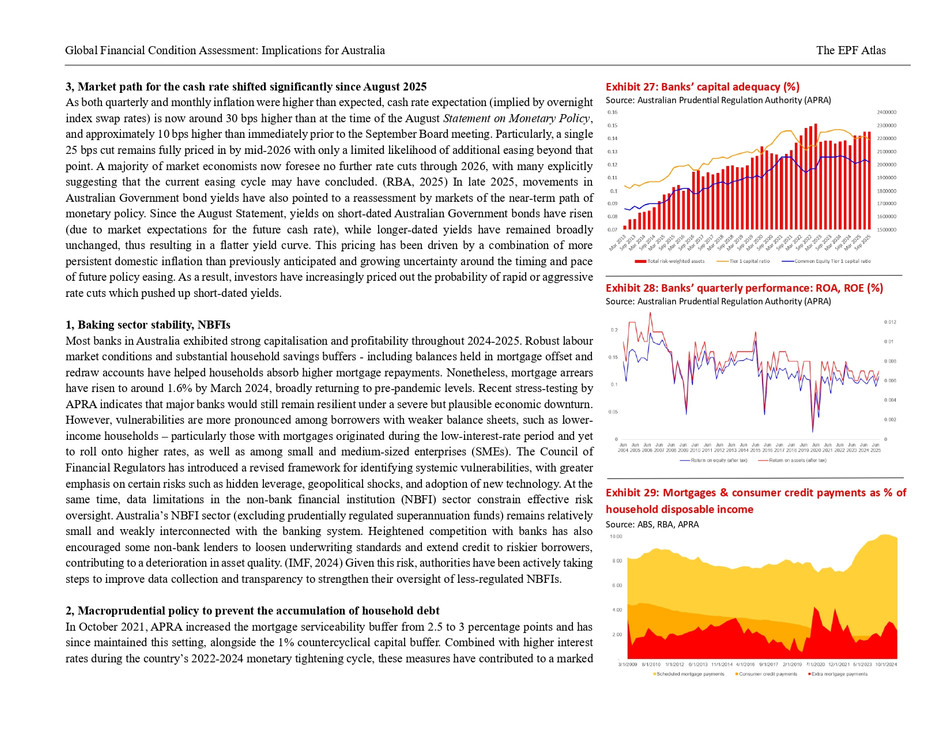

This report assesses the global macro-financial environment and its implications for Australia’s financial stability, with a focus on non-bank financial institutions (NBFIs), sovereign debt dynamics in advanced economies and banking sector funding resilience. Despite a rapid recovery in global risk sentiment following volatility in early 2025, underlying vulnerabilities persist, including elevated leverage and liquidity mismatches in parts of the global NBFI sector, rising sovereign issuance and term premia, and structural weaknesses in China’s property and banking systems.

For Australia, the primary risks arise through indirect channels rather than direct exposures. Global repricing of risk could tighten offshore wholesale funding conditions, raise long-term yields, and transmit higher borrowing costs to households, corporates and governments. While Australian banks and superannuation funds are well capitalised and have strengthened liquidity buffers, extreme global stress scenarios could still amplify funding and market pressures - particularly through procyclical behaviour in global financial markets.